Some Known Facts About Auto Insurance Agent In Jefferson Ga.

Table of ContentsThe Basic Principles Of Business Insurance Agent In Jefferson Ga A Biased View of Business Insurance Agent In Jefferson GaHow Insurance Agency In Jefferson Ga can Save You Time, Stress, and Money.Not known Details About Business Insurance Agent In Jefferson Ga The 10-Minute Rule for Life Insurance Agent In Jefferson GaSome Known Details About Business Insurance Agent In Jefferson Ga

Some of the most common reasons for getting life insurance policy consist of: 1. Surefire defense, If you have a household, an organization, or others who rely on you, the life insurance policy advantage of an entire life policy works as a financial safety and security net. When you pass away, your beneficiaries will certainly get a lump-sum repayment that is ensured to be paid completely (provided all costs are paid and there are no superior finances).- Income replacement, Picture what would take place to your family if the income you give all of a sudden disappeared. With whole life insurance, you can assist ensure that your enjoyed ones have the money they need to help: Pay the home mortgage Afford childcare, wellness care, or various other services Cover tuition or other college expenditures Remove home debt Preserve a family organization 3.

Your agent can aid you make a decision if any one of these motorcyclists are right for you.

Rumored Buzz on Life Insurance Agent In Jefferson Ga

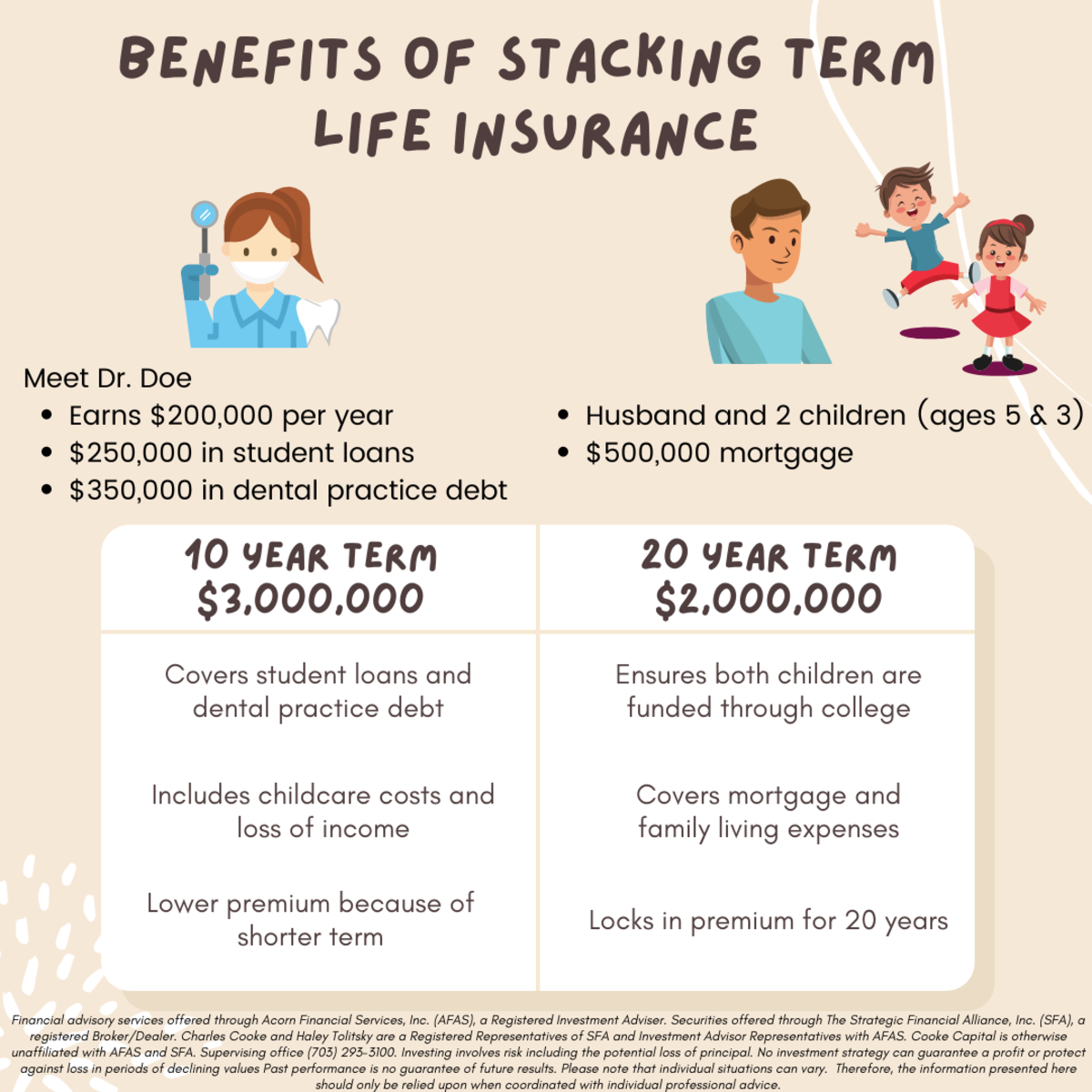

Some insurance providers use final expenditure policies. These policies have reduced protection amounts and relatively inexpensive monthly costs. A typical guideline claims your life insurance coverage fatality benefit should deserve 10 times your income. If you have a policy (or plans) of that dimension, individuals that depend upon your income will still have money to cover their continuous living costs.

You may want more if you would love to cover various other major costs (Insurance Agent in Jefferson GA). For example, you would certainly like the insurance coverage to pay for your kids's university education, so they don't need to take out student fundings. If you have whole lots of various other financial savings, you might be ok with a smaller sized life insurance coverage plan.

One reason is that people think life insurance policy is more costly than it is. 8 out of 10 Millennials overestimated the expense of life insurance in a 2022 research study. When asked to estimate the expense of a $250,000 term life plan for a healthy 30-year-old, the majority of survey respondents presumed $1,000 per year or more.

Not known Incorrect Statements About Auto Insurance Agent In Jefferson Ga

Entire life begins out costing much more, however can last your entire life if you maintain paying the premiums. Life insurance coverage covers your final expenses, like a funeral and funeral, when you pass away.

OGB provides 2 fully-insured life insurance policy prepare for workers and retired people via. The state pays half of the life insurance policy premium for covered employees and retirees. Both plans of life insurance coverage available, along with the equivalent quantities of dependent life insurance policy used under each plan, are noted below.

Top Guidelines Of Business Insurance Agent In Jefferson Ga

Term Life insurance is a pure transfer of threat in exchange for the repayment of costs. Prudential, and prior providers, have actually been supplying coverage and presuming danger for the repayment of costs. In the event a covered individual were to pass, Prudential would honor their obligation/contract and pay the advantage.

44/month Crucial Notes Newly hired employees who enlist within 1 month of work are qualified for life insurance coverage without providing proof of insurability. Employees that enlist in the life insurance strategy after 1 month are required to supply evidence of insurability to the insurer. Plan participants presently enrolled that desire to include dependent life protection for a partner can do so by providing evidence of insurability.

Things about Auto Insurance Agent In Jefferson Ga

Our team believe it is vital to give you with time off for relaxation, recreation, or to participate in to other individual needs. We offer time off with flexible pause, and 12 vacations per year, including core, regional, and/or personal holidays. We provide special time off for various other life occasions such as grief and court obligation and provide a variety of various other paid and unsettled leaves of absence, such as adult leave, special needs leave, military leave, family/medical leave, and personal leave.

Plan advantages are decreased by any impressive financing or lending rate of interest and/or withdrawals. If the policy lapses, or is surrendered, any superior finances thought about gain in the policy may be subject to average earnings tax obligations. https://dzone.com/users/5015615/jonfromalfa1.html.

The money surrender worth, lending value and death earnings payable will be minimized by any type of lien superior due to the payment of a sped up benefit under this rider. The accelerated advantages in the very first year mirror deduction of a single $250 management fee, recommended you read indexed at a rising cost of living price of 3% annually to the rate of acceleration.

The 8-Minute Rule for Insurance Agent In Jefferson Ga

A Waiver of Premium rider waives the responsibility for the insurance holder to pay more costs must he or she end up being completely handicapped continually for at the very least 6 months. This rider will sustain an extra price. See policy agreement for extra information and needs.

The advantages of cars and truck insurance policy abound, specifically if you are associated with a crash. Without insurance policy, you pay for damages out of pocket and browse the consequences on your own - http://connect.releasewire.com/company/details/alfa-insurance-jonathan-portillo-agency-327356.htm. If you have actually ever before been associated with a car mishap, you understand exactly how laborious and time-consuming the whole results can be